Summary:

- Debt consolidation combines multiple debts into one payment, but it does not erase the balance.

- Debt consolidation works best for people with a steady income and decent credit.

- If your debt is overwhelming, bankruptcy may offer stronger protections and a faster reset.

By Kelly Overton

Evergreen Financial Counseling helps people sort through debt options without pressure or shame. We counsel thousands of clients each month on their debt options, and debt consolidation is one of the most common strategies people ask about. Often, our clients are confused about the difference between debt consolidation with debt settlement. Beyond that, some people might be surprised to learn that bankruptcy is a smarter, safer option.

So how does debt consolidation work? In this article, we will look at the pros and cons, and we will answer the frequently asked questions about debt consolidation.

That said, before you consider your options, watch this short video on how bankruptcy compares to other options. And keep in mind that you can always schedule a free debt analysis with a debt professional to learn more about your options.

FAQ: What does debt consolidation mean in simple terms?

Debt consolidation means that you roll several debts into one new loan, and that loan pays off the balances of your old debt. Instead of juggling five or six payments, you would make just one payment with a debt consolidation loan.

Debt consolidation does not reduce the amount you owe, but it can simplify your life. Many people find relief in knowing they have a single due date, one interest rate, and a clear payoff timeline. In some cases, the interest rate is lower than what they were paying across credit cards, which can help save money over time. Consolidation loans also spread payments out over a set term, usually three to five years. That means the monthly bill may be lower than your combined credit card minimums, which makes repayment feel easier. The tradeoff is that paying over more years may increase your total interest costs.

Pros of Debt Consolidation | Cons of Debt Consolidation |

Make payment instead of juggling several | Does not reduce the total balance owed |

Single interest rate to track | Paying over more years may increase total interest costs |

Lower interest rate possible compared to credit cards | Risk of falling back into debt if new charges are added |

Fixed payoff timeline (usually 3–5 years) | No legal protections against collections or lawsuits |

Monthly payment may be lower than combined minimums | Not a true reset like bankruptcy can provide |

Can make repayment feel more manageable |

It is important to remember that consolidation does not erase debt. You still owe the full balance, and if you run up new charges on top of the consolidation loan, you may end up in deeper debt than before.

By contrast, bankruptcy can eliminate qualifying debts outright under court protection, giving you a true reset rather than a restructured payment plan.

If you are considering a debt consolidation loan, we suggest meeting with a professional for a free debt analysis.

Back to Top

FAQ: How does a debt consolidation loan work?

Think of debt consolidation as trading in a messy stack of bills for one structured loan. Instead of keeping track of multiple due dates, interest rates, and minimum payments, you would roll everything into a single account. The debt consolidation lender would pay off your old balances (e.g., credit cards, medical bills, and personal loans), and in return, you would make one fixed monthly payment to the debt consolidation lender.

There are several common ways to consolidate your debt into one loan:

Personal loans, which are usually unsecured, with fixed interest rates and repayment terms of three to five years.

Balance-transfer credit cards: These sometimes offer a 0% introductory rate, which can save interest if you pay the balance before the promo period ends.

Home equity loans or lines of credit: Secured by your home, these often carry lower rates but come with the serious risk of foreclosure if you fall behind.

Beware: If you use a debt consolidation loan to pay off your credit cards but then run those cards back up again, you’ll end up with double the debt. With this in mind, we advise people who are considering debt consolidation to first speak with a debt professional about their options. Bankruptcy may be the safer option since it eliminates qualifying debt outright rather than reorganizing it into a new loan.

Back to Top

FAQ: Is debt consolidation the same as debt settlement?

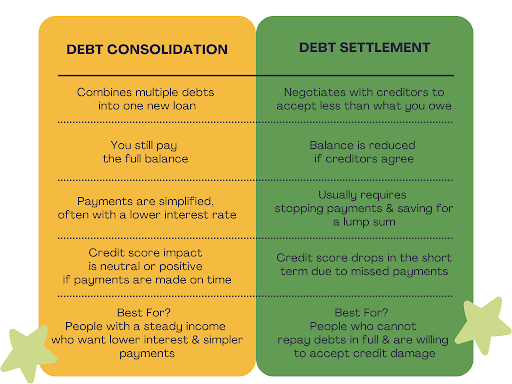

No. These two options are very different, though many companies blur the line when they advertise.

Under debt consolidation, you borrow money to pay off existing debts. You still owe the full balance, but repayment is simplified, and interest may be reduced.

Under debt settlement, you stop paying creditors and instead save money while a company negotiates to pay less than the full balance. This damages credit and depends on creditor approval.

FAQ: Can you get debt consolidation with bad credit?

It is possible to get debt consolidation if you have a bad credit score, but you will likely pay a high interest rate on your debt consolidation loan. The best rates for consolidation loans are reserved for people with good credit scores. With poor credit, you may only qualify for high-interest loans, which can leave you paying more over time.

Some lenders offer “bad credit consolidation loans,” but these often come with double-digit interest rates, origination fees, and longer terms. In some cases, you may end up paying back far more than if you had simply continued making payments on your existing accounts.

For people with poor credit and overwhelming debt, bankruptcy may be the better option because it provides a true reset instead of adding another costly loan. The word “bankruptcy” often carries unnecessary stigma, so if it makes you feel uneasy, this video can help put it in perspective.

FAQ: What kinds of debt can be consolidated?

Most unsecured debts can be included in a debt consolidation loan, but secured debts cannot be. This means credit cards, medical bills, payday loans, and personal loans are usually eligible. Since these debts aren’t tied to collateral, you can roll them into one loan to make repayment easier.

Secured debts, however, are rarely consolidated. Mortgages and auto loans, for instance, are tied to your house or car. These are typically excluded from debt consolidation loans because you already have collateral on the line, and lenders don’t want to restructure them into an unsecured consolidation loan.

There are exceptions, such as using a home equity loan or line of credit to pay off unsecured debts. But including these in a debt consolidation loan puts your home at risk if you fall behind, which is why many financial counselors caution against it.

Back to Top

FAQ: Does debt consolidation hurt your credit score?

At first, a debt consolidation loan might hurt your credit score. Applying for a new loan involves a hard credit inquiry, which can cause a small dip. Your score may also drop slightly when you open a new account because the average age of your credit history decreases.

Over time, though, a debt consolidation loan can help your credit score if you manage it well. Paying off credit cards with a consolidation loan lowers your credit utilization ratio, one of the biggest factors in your score. As long as you make consistent, on-time payments on the new loan and avoid running balances back up on your cards, your score can improve steadily.

Be sure to enroll in our free course, 7 Steps to a 720 Credit Score, to learn how to safeguard your credit score and build it quickly (generally within a year or two).

One way or another, beware of this pitfall of debt consolidation loans: If you consolidate your debt into one loan, and then charge up your credit cards again, you now have a consolidation loan and fresh credit card debt, which leaves you worse than where you started. If you are worried that you don’t have the discipline to avoid this pitfall, talk to a debt professional about other avenues to relieve your debt. The conversation is free, and you might learn that debt consolidation isn’t your best option.

Back to Top

FAQ: Is debt consolidation better than bankruptcy?

It depends on your situation. If your debt is large but still manageable (meaning you have steady income and the new loan payments fit your budget) consolidation can be a helpful tool. It gives you a defined end date and may reduce interest costs.

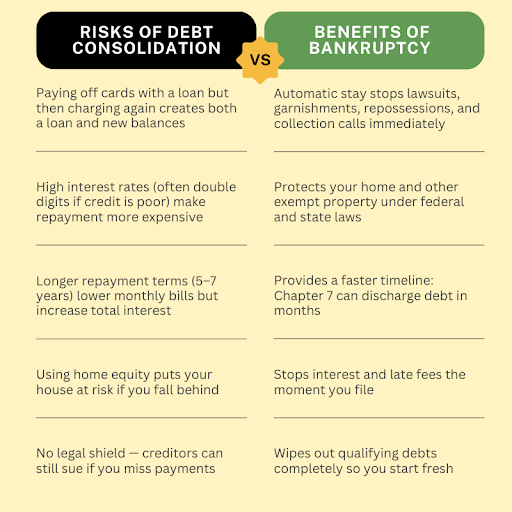

If your debt is overwhelming, bankruptcy often provides stronger relief. Bankruptcy is a federal process that immediately stops lawsuits, garnishments, repossessions, and collection calls through something called an automatic stay. Beyond that first layer of protection, bankruptcy can wipe out qualifying debts entirely and give you a true legal reset, something consolidation can’t provide since it still requires full repayment.

Bankruptcy vs. Debt Consolidation

Bankruptcy | Debt Consolidation |

Stops everything immediately — lawsuits, garnishments, repossessions, foreclosures, and collection calls through the automatic stay | Does not stop lawsuits or collection activity; creditors can still sue |

Eliminates qualifying debts completely | You still repay the full balance |

Legal protection — backed by federal law and the court system | No legal protection; relies on creditors agreeing to terms |

Fresh start — wipes the slate clean and lets you rebuild credit sooner | Extends repayment for years and keeps debt hanging over you |

Credit recovery begins quickly — most people start seeing improvement within months | Credit impact depends on long repayment and interest; score may not improve until loan is paid down |

Often less expensive overall — one-time court and attorney fees | Ongoing interest and fees can add up, making repayment more costly |

Peace of mind — removes the burden of overwhelming debt | Still carries the stress of owing every dollar |

Back to Top

FAQ: What’s the difference between a balance transfer and debt consolidation?

A balance transfer is one form of debt consolidation, but it works differently than a consolidation loan. With a balance transfer, you move your credit card balances onto a new card, often with a 0% introductory interest rate. If you pay the balance in full before the promotional period ends, you save money on interest. But if you do not, the rate usually jumps, sometimes higher than what you started with.

Debt consolidation loans, on the other hand, are installment loans with fixed rates and terms that typically last three to five years. They provide predictability. You will pay the same payment every month until the loan is finished, but they do not have the short-term benefit of a 0% interest.

Each tool has its pros and cons. Balance transfers can be powerful for smaller debts that you can pay quickly, while consolidation loans are better for larger debts that need a longer payoff period.

Back to Top

FAQ: What are the risks of debt consolidation?

The biggest risks of debt consolidation come from the possibility of ending up in deeper debt or paying more over time. If you pay off your cards with a loan and then start charging again, you end up with both the loan and new balances.

Beyond that, here are three other risks:

If you have poor credit, consolidation loans may carry double-digit interest rates that cost more than your current debts.

Longer repayment terms can make payments feel easier but increase the total interest you pay.

And if you use home equity, you risk foreclosure if you fall behind.

Bankruptcy is not the right option for everyone, but very often, the benefits of bankruptcy are substantial when compared to the risks of debt consolidation.

If you are unclear on what your next move is, be sure to schedule a free consultation with a debt professional who can help you weigh your options.

Back to Top

About Kelly Overton

Kelly Overton is the executive director of Evergreen Financial Counseling. She has spent more than a decade supporting consumer bankruptcy clients and attorneys. With a focus on streamlining services, improving client satisfaction, and driving stronger results for law firms, Kelly leads Evergreen’s mission to handle the outreach, education, and ongoing communication clients need both before and after filing.

Under her leadership, Evergreen has become a trusted, compliant partner for attorneys who want peace of mind, better client outcomes, a more efficient workflow, and a reputation for delivering a full-circle experience that builds lasting trust and referrals.