As a nonprofit, Evergreen Financial Counseling works with thousands of people every month who are facing debt. Our goal is to help them find relief without pressure or shame. Debt settlement is one option, but it’s often misunderstood. In fact, once people understand both debt settlement and bankruptcy, they often decide that bankruptcy is a better option.

How Does Debt Settlement Work?

Here are the basics: Debt settlement works by signing up with a company, stopping payments to your creditors, and instead saving money each month in a separate account. Once enough builds up, the company negotiates with one creditor at a time for a lump-sum payoff, and the process repeats until all debts are addressed, usually over two to four years.

Along the way, your credit is damaged, fees are high, forgiven debt may be taxed, and creditors can still sue. By contrast, bankruptcy immediately stops lawsuits, wipes out debt through court protection, and lets you start rebuilding credit faster.

In this article, then, let’s answer the questions people ask most about debt settlement so you can see the full picture. But first, watch this video so that you understand bankruptcy as an alternative to debt settlement.

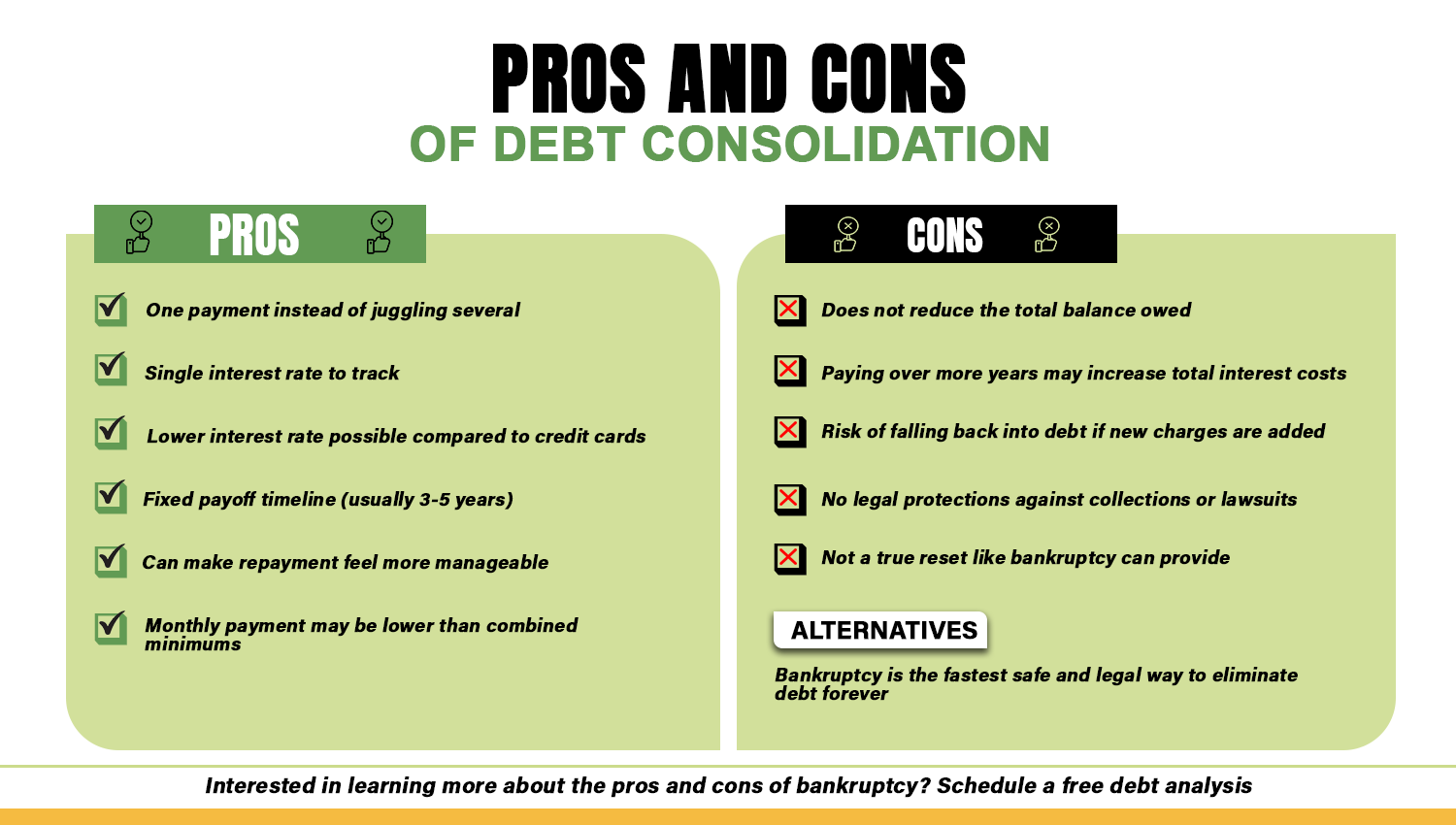

If you are interested in learning more about the pros and cons of bankruptcy, schedule a free debt analysis with a debt professional.

Frequently Asked Questions

1. What is debt settlement?

2. How is debt settlement different from debt consolidation?

3. What are the cons of debt settlement?

4. Is debt settlement a good idea or a scam?

5. Will debt settlement hurt my credit score?

6. Can creditors refuse to settle my debt?

7. Under debt settlement, will I owe taxes on forgiven debt?

8. How much does debt settlement cost?

9. How long does debt settlement take?

10. Is bankruptcy better than debt settlement?

11. Can I do debt settlement myself?

FAQ: What is debt settlement?

Debt settlement is when you (or a debt settlement company working on your behalf) negotiate with your creditors to accept less than what you owe. For example, if you owe $20,000, a debt settlement company may try to settle your bills for $10,000 or $12,000. You then pay that reduced amount, usually in one lump sum.

Most settlement companies ask you to stop paying your creditors and instead put money into a savings account until you’ve saved enough to make the settlement offer. Because most people owe multiple creditors, settlements often happen one account at a time. That means one credit card may get settled this year, another the next, and so on until every creditor is addressed.

Key takeaway: Debt settlement can reduce your balance, but it doesn’t erase debt instantly. It usually requires lump-sum payments, and settlements are often staggered over time, one bill at a time.

FAQ: How is debt settlement different from debt consolidation?

Debt settlement aims to reduce your total balance, while debt consolidation combines multiple debts into one loan or payment plan.

Debt settlement involves negotiating with creditors to accept less than the total amount owed. For example, if someone owes $20,000, a settlement company may negotiate to settle it for $10,000–$12,000. It usually requires stopping payments while saving up for a lump-sum settlement, which can damage credit in the short term. The benefit is that it reduces the principal balance, potentially saving thousands of dollars.

Debt consolidation combines multiple debts into one new loan or structured repayment plan. While it does not reduce the amount owed, it can simplify finances by replacing several payments with a single one, often at a lower interest rate. This helps borrowers stay current and avoid late fees, but they will still repay the full balance over time.

Many companies blur the distinction by advertising “consolidation” when what they are really selling is settlement. That’s why it’s important to understand the terms clearly.

| Comparison | Debt Settlement | Debt Consolidation |

| Goal | Reduce total balance owed | Simplify payments, lower interest rate |

| Balance Owed | Reduced (creditors accept less) | Full balance still owed |

| Payment Structure | Usually lump-sum after saving | Single monthly payment |

| Impact on Credit Score | Negative in short term (missed payments) | Neutral to slightly positive if paid on time |

| Cost Savings | Can save thousands by reducing principal | Savings come from reduced interest, not balance |

| Time to Complete | Typically 2–4 years | Depends on loan term (often 3–7 years) |

| Risks | Credit damage, potential tax consequences | Risk of default if new loan not repaid |

| Best For | Those unable to repay full balances | Those with steady income but high interest debt |

Key takeaway: Debt settlement reduces the balance you owe, while debt consolidation reorganizes debt into a single, more manageable payment without reducing the total.

FAQ: What are the cons of debt settlement?

The cons of debt settlement include damaged credit, high fees, legal risks, and possible tax bills. Creditors are not required to accept a settlement, so you could save for months only to have them refuse. While you’re saving, your accounts stay delinquent and your credit score keeps falling. Even when a debt is settled, it appears as “settled for less than full balance” instead of “paid in full,” and that mark remains for up to seven years.

You may also be sued while waiting to settle, and many people are surprised when the IRS treats forgiven debt as taxable income. On top of that, settlement companies often charge thousands in fees, making the process more expensive than expected.

Key takeaway: Debt settlement can reduce balances, but it damages credit, carries legal and tax risks, and often costs more than expected.

FAQ: Is debt settlement a good idea or a scam?

Debt settlement can help in some cases, especially if your debts are already in collections and you want to avoid bankruptcy, but there are serious risks. Many companies overpromise results, charge steep fees, and leave clients vulnerable to lawsuits while they wait for a settlement.

For many people, bankruptcy is actually the safer path. Bankruptcy is a federal legal process that immediately stops lawsuits, garnishments, and collection calls through the automatic stay (11 U.S. Code § 362). Unlike debt settlement, bankruptcy doesn’t rely on creditor approval. It provides court protection and a faster path to rebuilding credit.

(If you are interested in learning more about the pros and cons of bankruptcy, schedule a free debt analysis with a debt professional.)

Comparison: Debt Settlement vs. Bankruptcy

| Comparison | Debt Settlement | Bankruptcy |

| Creditor approval | Not guaranteed | Not needed – court order discharges debt |

| Lawsuit protection | None | Full legal protection through automatic stay |

| Time to finish | 2–4 years | Chapter 7: 3–6 months, Chapter 13: 3–5 years |

| Credit recovery | 4–6 years | Can begin immediately after discharge |

| Costs | 15–25% fees + settlements | Court filing + attorney fees, usually less overall |

| Taxes on forgiven debt | Yes (IRS treats as income) | No – discharged debt is not taxable (IRS Pub. 4681) |

Key takeaway: Debt settlement isn’t always a scam, but it is often riskier and slower than bankruptcy. Bankruptcy gives legal protection and a cleaner reset.

FAQ: Will debt settlement hurt my credit score?

Yes, debt settlement damages your credit because you stop making payments while saving up. Accounts become delinquent, and even when settled, they show as “settled for less than full balance.” That mark stays for up to seven years.

Rebuilding your credit score after debt settlement can take 4 to 6 years. By contrast, bankruptcy usually allows you to start rebuilding within months. Studies from the Federal Reserve and ProPublica show that many people who file bankruptcy start seeing improvements in their credit score within a year, and people who take the free credit education course, 7 Steps to a 720 Credit Score, after bankruptcy see their scores improve to 720 a year or two after filing.

If you are interested in learning more about the pros and cons of bankruptcy, schedule a free debt analysis with a debt professional.

Key takeaway: Debt settlement lowers your score and delays recovery. Bankruptcy typically allows your credit score to rebound faster.

FAQ: Can creditors refuse to settle my debt?

Creditors do not have to accept a settlement offer. Some may agree, others may refuse, and while you’re saving money, they can still pursue collections or sue you.

Bankruptcy is different. Once you qualify for bankruptcy and file your paperwork, your creditors cannot refuse to eliminate qualified debt. The discharge is a legal court order, so all eligible debts must be wiped out, whether creditors like it or not.

Beyond that, once you file, something called an automatic stay goes into effect immediately. This is a powerful court order that stops nearly all collection activity at once. Lawsuits, wage garnishments, foreclosures, repossessions, and nonstop phone calls must stop the moment your case is filed. Creditors cannot ignore it or refuse to comply.

Watch this video to learn more. And if you are interested in learning more about the pros and cons of bankruptcy, schedule a free debt analysis with a debt professional.

Key takeaway: Debt settlement depends on creditor approval, while bankruptcy guarantees resolution.

FAQ: Under debt settlement, will I owe taxes on forgiven debt?

Often, yes. The IRS treats forgiven debt as taxable income (IRS Publication 4681), so you might end up paying taxes on debt that is forgiven under a debt settlement agreement.

For instance, if you settle $20,000 in debt for $12,000, the $8,000 difference can be reported as income on a 1099-C form. That means you may face an unexpected tax bill.

Bankruptcy is different. Discharged debts are not considered taxable income, so you don’t owe taxes on the amount wiped out.

Key takeaway: Debt settlement can create new tax problems, while bankruptcy eliminates debt without adding tax liability.

FAQ: How much does debt settlement cost?

Debt settlement companies usually charge 15–25% of the total debt you enroll. If you try to settle $20,000, fees may run $3,000–$5,000 on top of what you pay creditors.

By contrast, bankruptcy has court filing fees (about $338 for Chapter 7, $313 for Chapter 13) and attorney fees that vary by state, but overall costs are often less than a multi-year settlement program. Read this article to learn how much it costs to file bankruptcy.

Key takeaway: Debt settlement fees are high, while bankruptcy is often more affordable overall.

FAQ: How long does debt settlement take?

Debt settlement programs usually take two to four years. During that time, your credit remains damaged, you may face lawsuits, and progress is uncertain until each creditor agrees.

That’s because settlement doesn’t erase all debts at once. Each account has to be negotiated separately, and there’s no guarantee that every creditor will accept a deal. You might settle one account, but another could refuse, sue, or keep adding fees and interest.

Here’s how it typically works: instead of paying your creditors directly, you send money each month into a separate savings account managed by the settlement company. Once enough builds up, the company approaches one creditor and tries to strike a deal for a lump-sum payment. If the creditor accepts, the account is used to pay them off. Then the process repeats with the next creditor, and so on.

Because this happens one debt at a time, you’re never sure how long it will take, how many creditors will agree, or how much you’ll truly end up paying.

Bankruptcy is faster. Chapter 7 typically resolves debts in three to six months. Chapter 13 takes three to five years, but provides immediate legal protection and a structured repayment plan backed by the court.

Comparison: Timeline to Resolution

| Option | Timeframe | Protections |

| Debt settlement | 24–48 months | None |

| Chapter 7 bankruptcy | 3–6 months | Automatic stay halts lawsuits |

| Chapter 13 bankruptcy | 36–60 months | Automatic stay + court-approved repayment |

Key takeaway: Debt settlement takes years and offers no protection. Bankruptcy resolves debts faster and gives immediate relief.

FAQ: Is bankruptcy better than debt settlement?

For many people, yes, bankruptcy is a much better option than debt settlement.

Bankruptcy is a federal legal process that stops lawsuits, wipes out debt, and allows faster credit rebuilding. Debt settlement, on the other hand, has no legal protections, depends entirely on whether creditors agree, and often costs more in the long run.

Here’s why bankruptcy is often the stronger choice:

- Legal protection: The moment you file bankruptcy, an automatic stay goes into effect. This court order immediately halts lawsuits, wage garnishments, foreclosure, repossession, and collection calls. Debt settlement cannot provide this protection. While you’re saving money in a settlement program, creditors can still sue you or garnish your wages.

- Guaranteed resolution: In bankruptcy, creditors do not get to pick and choose. Once your case is filed and approved, all eligible debts must be discharged. With debt settlement, every single account has to be negotiated separately, and some creditors may refuse to settle your debt altogether. That leaves progress uncertain.

- Timeframe: Bankruptcy is typically much faster. Chapter 7 cases are usually completed in three to six months, and Chapter 13 offers a court-approved repayment plan lasting three to five years. Settlement programs typically last two to four years, but delays, lawsuits, and failed negotiations can stretch them out even longer.

- Credit recovery: Debt settlement keeps accounts delinquent for years, and even once settled, they show as “settled for less than full balance,” which lingers on your credit report for up to seven years. Bankruptcy, by contrast, gives you a clean break. While the bankruptcy filing itself stays on your credit report, many people receive credit card offers within a year, and FHA or VA home loans may be available in as little as two to three years.

- Costs: Debt settlement companies typically charge 15–25% of your total debt in fees. If you enroll $20,000 in debt, fees alone may cost $3,000–$5,000, plus the settlement payments you make to creditors. Bankruptcy has court filing fees (about $338 for Chapter 7, $313 for Chapter 13) and attorney fees that vary by state, but overall, it often costs less than a long settlement program. (Read this article to learn how much it costs to file bankruptcy. )

- Taxes: The IRS often treats forgiven debt from settlement as taxable income. Settle $20,000 for $12,000, and you may get a 1099-C showing $8,000 of taxable income. Bankruptcy is different. Discharged debts are not taxable, so you don’t face a surprise IRS bill.

Comparison: Bankruptcy vs. Debt Settlement

| Comparison | Debt Settlement | Bankruptcy |

| Creditor approval | Required | Not required – court order |

| Legal protections | None | Automatic stay stops collections |

| Timeline | 2–4 years, uncertain | Chapter 7: 3–6 months; Chapter 13: 3–5 years |

| Credit recovery | 4–6 years to rebound | Often begins within months |

| Fees | 15–25% of enrolled debt | Court + attorney fees (usually less overall) |

| Taxes on forgiven debt | Yes, considered income | No, discharged debt not taxable |

The Consumer Financial Protection Bureau (CFPB) has cautioned that debt settlement programs often leave consumers worse off, since missed payments can trigger lawsuits and ballooning fees. Bankruptcy, by contrast, is a federal process that provides certainty and long-term protection once eligibility is met.

Key takeaway: Bankruptcy often provides stronger relief, faster recovery, and full legal protections. While some people benefit from debt settlement, it is usually the weaker option compared to the clean slate bankruptcy can provide.

FAQ: Can I do debt settlement myself?

Yes, you can call your creditors directly and negotiate a reduced payoff without hiring a settlement company. Many people have success doing this on their own, especially if they explain financial hardship clearly and can offer a lump-sum payment. The process takes persistence, record-keeping, and patience, but it can save thousands of dollars in fees compared to using a settlement firm.

| Comparison | DIY Settlement | Settlement Company |

| Fees | No extra fees | 15–25% of the settled debt or savings |

| Control | You handle all negotiations | Company negotiates on your behalf |

| Time & Effort | Requires persistence, phone calls, documentation | Less hands-on, but slower in some cases |

| Creditor Response | Some creditors may respond better to direct contact | Companies may have experience with certain creditors |

| Credit Impact | Still negative in short term if payments are paused | Same — negative until settlements are complete |

| Potential Savings | Higher (no fees) | Lower (fees eat into savings) |

| Best For | People comfortable negotiating and tracking details | People who want professional help despite fees |