By Philip Tirone

When I started my career as a mortgage broker more than 30 years ago, I quickly noticed something troubling. Some clients were offered great loans with low payments and almost no interest. Others, often just as hardworking and deserving, qualified for loans, but the terms were brutal. High rates, hidden fees, and punishing payment schedules kept them trapped in a debt cycle.

It didn’t sit right with me. So I created the free online course 7 Steps to a 720 Credit Score to show people how to rebuild their credit and qualify for better terms. Later, I adapted the program specifically for people coming out of bankruptcy … and along the way, I became a big fan of bankruptcy.

I didn’t start out that way. Early in my career, I would have told you that bankruptcy was something to avoid. But then I started to see that bankruptcy allows people to rebuild their credit faster than they otherwise would. I saw that bankruptcy is the fastest legal way to wipe away qualified debt. And I began to notice a double standard: Corporations and wealthholders with lots of legal advisors use bankruptcy all the time … and then turn around and shame everyday people for using it.

Banks want you to believe bankruptcy is scary, because fear keeps you paying late fees and high interest. But that just protects their pocketbooks at your expense.

That said, bankruptcy isn’t right for everyone. The only way to know if bankruptcy is right for you is to sit down for a free bankruptcy consultation with an attorney. In less than an hour, you’ll know your options, what you can protect, and whether a reset makes sense for you.

To help you prepare, I’ve put together answers to the most common questions people ask before their free bankruptcy consultation.

Related Resources:

If you would like to be paired with a bankruptcy attorney in your state who offers a free consultation, click here to schedule a meeting with a debt professional.

Table of Contents

Process and Experience

1. Do all bankruptcy lawyers offer a free consultation?

2. What happens at a free bankruptcy consultation?

3. How long does a free bankruptcy consultation take?

4. What documents do I need to bring to a free bankruptcy consultation?

5. Can a lawyer give me legal advice during a free bankruptcy consultation?

6. Are free bankruptcy consultations confidential?

7. Do I need to talk to a bankruptcy lawyer near me, or can I use one in another state?

8. What should I expect after the free consultation is over?

Cost and Value

9. Is a free bankruptcy consultation really free, or are there hidden fees?

10. How do bankruptcy attorneys make money if the consultation is free?

11. Is a free bankruptcy consultation worth my time?

12. Can a free consultation tell me if I qualify for Chapter 7 or Chapter 13?

13. What is the difference between a free bankruptcy consultation and meeting with a debt settlement company?

14. How does a free consultation with a bankruptcy attorney compare to a credit counseling session?

15. Will a free bankruptcy consultation help me feel less stressed about my debt?

Decision-Making

16. What questions should I ask a lawyer during a free bankruptcy consultation?

17. How many bankruptcy consultations should I schedule before hiring a lawyer?

18. Can I decide not to file after a free bankruptcy consultation?

19. How do I know if I found the right lawyer after a free consultation?

FAQ: Do all bankruptcy lawyers offer a free consultation?

Yes, most bankruptcy lawyers do offer a free consultation. Attorney Adrienne Hines explains it well in this short video:

A free consultation is a chance to ask questions, explain your financial situation, and learn whether bankruptcy might be a good fit for you. If you would like to be paired with a bankruptcy attorney in your state who offers a free consultation, click here to schedule a meeting with a debt professional who can match you with the right lawyer.

FAQ: What happens at a free bankruptcy consultation?

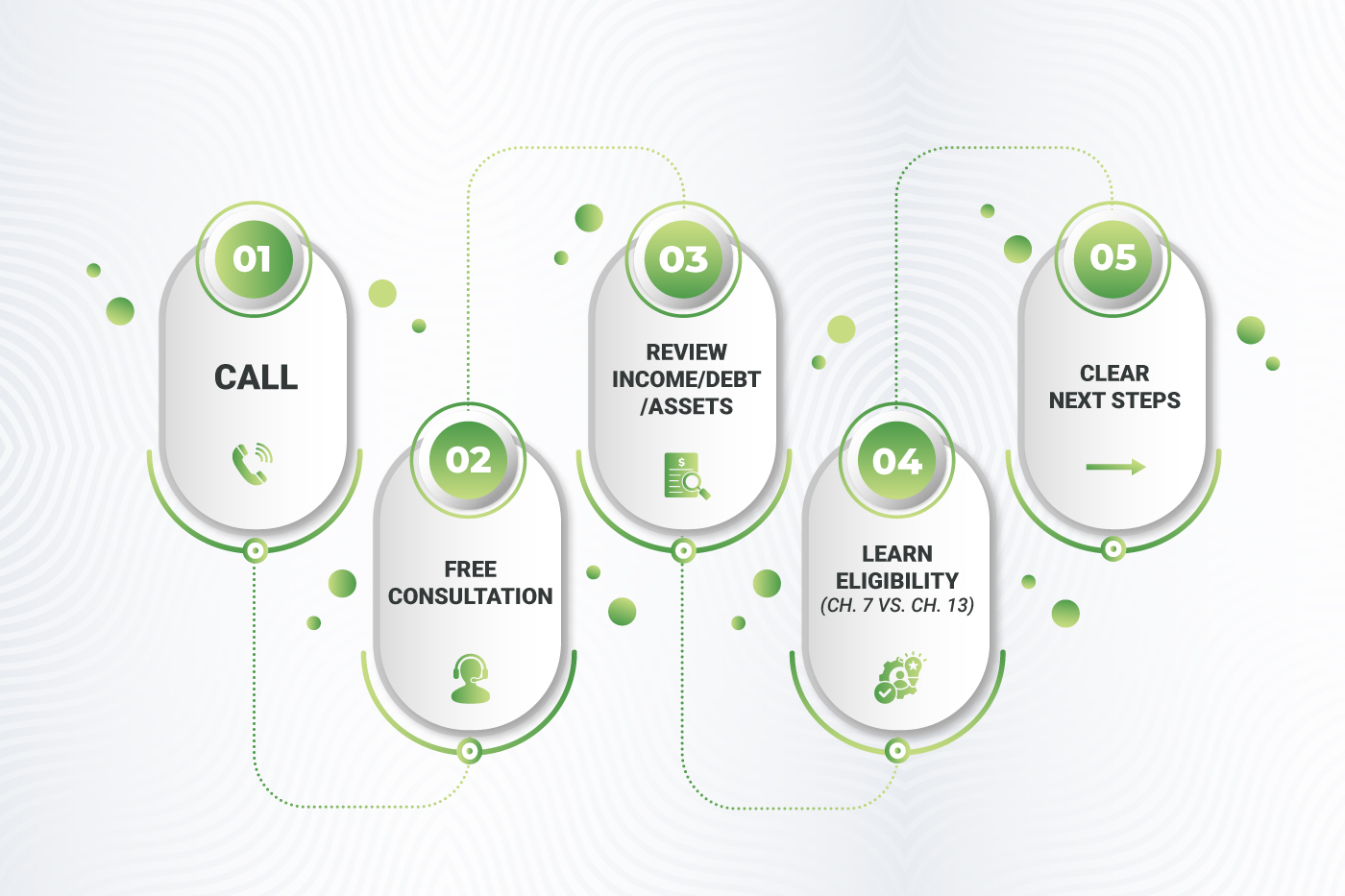

A free bankruptcy consultation is usually a 30- to 60-minute meeting where a lawyer reviews your income, debts, and assets under your state rules, screens you for Chapter 7 or Chapter 13, explains what you can keep, and gives you clear next steps. Generally, they happen over the phone or via video chat.

Watch this quick explanation from attorney Adrienne Hines:

Though each attorney has a different process, this is what is generally covered:

- Snapshot of your situation: The attorney will ask you questions about your income, household size, monthly expenses, total debts, and assets like your home and cars.

- Means test screening: The means test, required under the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA), compares your income and household size to your state’s median. As outlined by the U.S. Trustee Program at the Department of Justice, this test determines whether you qualify for Chapter 7 bankruptcy. If Chapter 7 isn’t a fit, your attorney will explain how Chapter 13 works and what repayment might look like.

(Watch this video for an explanation of the difference between Chapter 7 and Chapter 13 bankruptcy.)

- Exemptions and asset protection: You will learn what property is protected by your state exemptions and what equity might be at risk.

- House and car review: The attorney will ask you questions about loan balances, equity, reaffirmation options. You will learn more about what happens to secured debt under Chapter 7 and Chapter 13 bankruptcy laws in your state.

- Timeline and process: The lawyer will explain the steps and the general timeline from beginning to discharge.

- Alternatives to bankruptcy: You can talk about the pros and cons of other options, such as payment plans, negotiation, nonprofit credit counseling, or waiting and monitoring.

- Cost and fee structure: The lawyer will explain fees, court costs, and payment options. You’ll also discuss strategies for freeing up money so that you can afford bankruptcy.

- Questions: You will have time to address your concerns and address your specific circumstances, such as wage garnishments, lawsuits, collections, recent transfers, or new debt.

- Next steps and homework: You will leave with a document list and a plan. If you want to move forward, the office will schedule the follow-up and send engagement paperwork.

Key takeaway: A free bankruptcy consultation is your chance to get clarity. In less than an hour, you’ll walk away knowing whether Chapter 7 or Chapter 13 fits your situation, what property you can keep, what the process will look like, and what other options you might have. You leave with answers, a document checklist, and a concrete plan.

FAQ: How long does a free bankruptcy consultation take?

A free bankruptcy consultation usually takes between 30 and 60 minutes. The length depends on your financial situation, how many questions you bring, and the attorney’s process. Some attorneys will keep the consultation tightly focused on eligibility and next steps, while others will take more time to walk through every detail of your budget, assets, and debts.

Consultations might be shorter if the situation is straightforward. For example, if someone qualifies clearly for Chapter 7 and has very few assets, the consultation might take 20 minutes. For other people, the consultation will take closer to an hour if there are multiple properties, self-employment income, or questions about wage garnishments, lawsuits, or recent transfers.

Key takeaway: Most free bankruptcy consultations last 30 to 60 minutes. The exact length depends on the attorney’s style and your financial complexity, but you should leave the appointment with clear next steps and a better understanding of your options.

If you would like to be paired with a bankruptcy attorney in your state who offers a free consultation, click here to schedule a meeting with a debt professional.

FAQ: What documents do I need to bring to a free bankruptcy consultation?

Most lawyers ask you to bring recent pay stubs, tax returns, a list of debts, bank statements, and any paperwork about your house, car, or lawsuits. The more accurate your documents, the faster your lawyer can tell you if Chapter 7 or Chapter 13 is right for you.

That said, you don’t always need every document for the first meeting, but the more complete your information is, the better guidance you’ll receive. A lawyer can give you a general idea without paperwork, but specific recommendations come from reviewing your actual income, debts, and assets.

Here are a few ways to prepare core documents for your bankruptcy consultation:

- Bring proof of income, such as recent pay stubs, unemployment statements, Social Security or disability benefits, or pension statements.

- Bring your tax returns from the last two years if you have them available.

- Have a list of debts, including recent credit card bills, medical bills, loan statements, and any collection notices.

- Bring bank statements, usually covering the last three to six months.

- Gather your property records, such as mortgage statements, car loan balances, car titles, or a recent property tax bill.

- Finally, include any legal or collection papers, like lawsuits, garnishment notices, foreclosure papers, or collection letters.

You might also want to bring:

- Retirement or investment account statements.

- Insurance policy details (especially life insurance with cash value).

Key takeaway: The more you prepare before your consultation, the more value you’ll get out of that free time with the lawyer. Even if you don’t have everything, bring what you can. The clearer your financial picture, the clearer your legal options will be.

FAQ: Can a lawyer give me legal advice during a free bankruptcy consultation?

Yes, during a free bankruptcy consultation, a lawyer can provide legal advice that is specific to your situation. That means they can explain how bankruptcy laws apply to your income, assets, and debts. Some of the conversation may sound like general information, such as the difference between Chapter 7 and Chapter 13, but once you share details about your finances, the lawyer shifts into giving actual legal guidance.

Attorneys often describe this moment as when “the law meets your life.” For example, one lawyer may explain that even though you qualify for Chapter 7 based on your income, keeping your second car may not be possible under your state’s exemption laws. That is tailored legal advice, and it’s exactly why the consultation is so valuable.

Key takeaway: A free consultation is educational in nature, but it provides a chance to get personalized legal advice that shows you what bankruptcy would look like in your life.

What’s the Difference Between a Chapter 7 and a Chapter 13 Bankruptcy?

FAQ: Are free bankruptcy consultations confidential?

Yes, according to the American Bar Association, attorney-client privilege applies even at a free bankruptcy consultation, protecting everything you share from disclosure. This is true even if you decide not to hire the attorney. That means anything you share about your finances, debts, or personal situation is legally protected and cannot be disclosed.

FAQ: Do I need to talk to a bankruptcy lawyer near me, or can I use one in another state?

You need to work with a bankruptcy lawyer who is licensed to practice in your state, but the attorney does not need to live in your state. Bankruptcy laws are federal, but the details of how they are applied—such as exemptions that decide what property you can keep, local court procedures, and trustee practices—vary from state to state.

For example, the amount of equity you can protect in a home or car is different in California than it is in Texas. A lawyer who only practices in another state cannot represent you in your local bankruptcy court, and may give you advice that doesn’t match your state’s rules.

That doesn’t always mean the lawyer must be physically in your city. Many attorneys now handle consultations by phone or video. What matters is that they are licensed in the state where you live and plan to file.

Key takeaway: Always work with a bankruptcy lawyer licensed in your state for two reasons. First, local exemptions and court procedures determine what property you can keep and how your case will be handled. Second, an attorney cannot represent you in a state where they are not licensed.

FAQ: What should I expect after the free consultation is over?

After the free consultation, the attorney will give you a list of documents to gather and outline the timeline for filing. If you decide to move forward, the office will schedule a follow-up and/or send engagement paperwork. Even if you choose not to file, you still leave with information about your options.

Most people walk into the consultation feeling nervous and uncertain. They often leave with relief, because they know whether Chapter 7 or Chapter 13 is a fit, what property they can keep, and what the process will look like.

Watch how attorney Adrienne Hines explains this:

Key takeaway: After the free consultation, you leave with clarity, a checklist of next steps, and a better understanding of your options.

FAQ: Is a free bankruptcy consultation really free, or are there hidden fees?

Yes, a free bankruptcy consultation is truly free. You don’t pay anything to sit down with the lawyer, talk through your situation, and hear your options. Under state bar ethics rules, attorneys must provide written fee agreements, which means all costs have to be clearly explained before you hire anyone.

A legitimate bankruptcy lawyer will not charge you for that first meeting, but where confusion comes in is that some people expect the consultation to cover everything, such as gathering documents, filing paperwork, and court representation. Those parts are not free.

The consultation is meant to give you a clear picture of whether bankruptcy makes sense for you. Attorneys make their money if you decide to move forward and hire them. At that point, you’ll receive a written agreement that spells out their fees and any court costs, so there are no surprises.

If you decide not to file bankruptcy through that attorney after the consultation, you don’t owe anything.

Key takeaway: A free bankruptcy consultation should never come with hidden fees. The meeting itself is free, and you’ll only pay if you choose to hire the lawyer to handle your case.

FAQ: How do bankruptcy attorneys make money if the consultation is free?

Bankruptcy attorneys make money when a client decides to move forward and hires them to file the case. The consultation itself is a way to build trust, answer questions, and show potential clients what working together will feel like. Think of it like a free financial planning session or a health screening: The professional gives you an overview at no cost, but the actual service is what you pay for.

Most lawyers view the free consultation as a chance to form a relationship. If you feel heard, respected, and supported, you’re more likely to hire them for the actual bankruptcy filing, which is where their fees come in.

Key takeaway: The consultation is free because it’s about trust-building. Lawyers are paid only if you choose to hire them for your bankruptcy case.

Be sure to read this related article: “How Much Does It Cost to File Bankruptcy?”

FAQ: Do all bankruptcy lawyers offer a free consultation?

Most bankruptcy lawyers offer free consultations, but not all of them. In many regions, it has become the standard because clients want to understand their options before committing. Larger firms almost always offer them, since they are set up to handle a high volume of calls. Solo practitioners may vary: Some provide a free first meeting, while others charge a modest fee that is later credited toward your case if you hire them.

FAQ: Is a free bankruptcy consultation worth my time?

Yes, a free bankruptcy consultation is often one of the most valuable hours you can spend if you’re struggling with debt.

For many people, emotions run high before the first meeting. Fear, shame, and uncertainty can make it hard to even pick up the phone. That first consultation is where things start to settle. You finally hear what bankruptcy would mean for you, not in theory but in practice, based on your exact finances.

It’s also the moment when myths get debunked. People often come in believing they’ll automatically lose their house, their car, or their job if they file. In reality, most clients discover they have far more protections and options than they thought.

Even if you decide not to file, you walk away with clarity. Many clients describe feeling relief after that first conversation, because they can make decisions with facts instead of fear.

Key takeaway: A free bankruptcy consultation is worth your time because it replaces stress and myths with facts and clarity, giving you the confidence to decide what comes next.

What Are Some of the Myths that Will Be Debunked?

Check out this short video with attorney Adrienne Hines …

FAQ: Can a free consultation tell me if I qualify for Chapter 7 or Chapter 13?

Yes, during a free consultation, the attorney will review your income, debts, household size, and assets to see if you qualify for Chapter 7 or Chapter 13. The Department of Justice regulates the bankruptcy courts and has established something called the “means test” to determine eligibility for Chapter 7. The means test compares your income and expenses to your state’s median levels. If your income is below the median, you may qualify for Chapter 7. If it is above, the attorney will run a second part of the test that looks at your expenses to see if you still have room to qualify.

If Chapter 7 is not a fit because of income or because you have property that would be at risk, the attorney will explain Chapter 13 and what repayment would look like. Many people discover their eligibility during the very first meeting, even if they walked in unsure whether bankruptcy was an option for them.

Watch how attorney Adrienne Hines explains this:

Key takeaway: A free bankruptcy consultation usually answers the Chapter 7 vs. Chapter 13 question on the spot. By reviewing your income, expenses, and assets, the attorney can show you which option fits and explain what the process would look like.

FAQ: What is the difference between a free bankruptcy consultation and meeting with a debt settlement company?

The difference is that a free bankruptcy consultation gives you legal advice and protection under the law, while a debt settlement company only negotiates with creditors without any legal safeguards.

In a free bankruptcy consultation, you meet with a licensed attorney who reviews your finances, explains how state and federal bankruptcy laws apply to you, and helps you understand whether Chapter 7 or Chapter 13 fits your situation. The consultation is protected by attorney-client privilege, and if you file, the automatic stay can immediately stop lawsuits, foreclosures, and collections.

A debt settlement company is not a law office. They try to negotiate with creditors to reduce what you owe, but they can’t stop lawsuits or wage garnishments. Most settlement companies ask you to stop paying creditors and put money into a savings account, which damages your credit and leaves you vulnerable while you wait.

Beware that the Consumer Financial Protection Bureau (CFPB) warns that debt settlement programs often encourage people to stop paying creditors, which can lead to lawsuits and wage garnishments. Even if settlement works, it can damage your credit for years and sometimes results in unexpected tax bills.

Bankruptcy Consultation vs. Debt Settlement Comparison

| Factor | Bankruptcy Consultation | Debt Settlement Company |

| Legal protection | Filing triggers the automatic stay, which immediately stops lawsuits, foreclosures, and collections. | No legal shield. Creditors can still sue, garnish wages, or pursue collections while you wait. |

| Cost | Fees are disclosed upfront in writing, and you only pay if you move forward with your case. | Percentage-based fees are added on top of what you pay creditors, often making it more expensive than expected. |

| Credit impact | Credit recovery starts sooner. Many clients qualify for new credit within 12–24 months after discharge. | Recovery is slow. Credit scores may take 4 to 6 years to fully bounce back. |

| Taxes | Discharged debts are not taxable. | Forgiven debt may be counted as taxable income, creating surprise IRS bills. |

| Finish line | Predictable timeline: 3 to 6 months for Chapter 7 or 3 to 5 years for Chapter 13 repayment. | Programs last 2 to 4 years with no guarantee every creditor will agree. |

Many people who try debt settlement end up in bankruptcy anyway, but only after losing valuable time and money. By contrast, a free bankruptcy consultation gives you answers without pressure, so you can decide with eyes wide open.

Key takeaway: Bankruptcy attorneys give you legal protection, clarity, and a defined path forward. Debt settlement companies only negotiate, often at a high cost, and leave you exposed to risk while you wait.

What Is the Automatic Stay?

FAQ: How does a free consultation with a bankruptcy attorney compare to a credit counseling session?

A free bankruptcy consultation is legal advice, whereas a credit counseling session is an educational course required before filing for bankruptcy. Both have value, but they serve different purposes.

According to the U.S. Trustee Program at the Department of Justice, all individuals must complete a credit counseling session from an approved nonprofit agency before filing bankruptcy. This session covers budgeting, credit use, and alternatives to bankruptcy, but it does not provide legal representation.

By contrast, a free bankruptcy consultation shows how the law applies to your specific finances and what bankruptcy would look like for you.

Bankruptcy Consultation vs. Credit Counseling Comparison

| Factor | Bankruptcy Consultation | Credit Counseling Session |

| Purpose | Gives legal advice and explains how bankruptcy law applies to you. | Provides education on budgeting, debt management, and alternatives to bankruptcy. |

| Provider | Licensed bankruptcy attorney. | Certified nonprofit counselor or agency. |

| Confidentiality | Protected by attorney–client privilege. | Confidential, but not legally privileged. |

| Legal power | Can stop lawsuits, collections, and foreclosures through bankruptcy. | Offers education and resources, but no legal advice. |

| Requirement | Optional, but the first step if you’re considering bankruptcy. | Mandatory before filing bankruptcy, but not a replacement for legal advice. |

| Who is it for? | People facing lawsuits, garnishments, foreclosure, or overwhelming debt. | People with income who need budgeting tools or want to explore alternatives. |

Key takeaway: A bankruptcy consultation gives you legal answers; credit counseling gives you financial education.

If you would like to be paired with a bankruptcy attorney in your state who offers a free consultation, click here to schedule a meeting with a debt professional.

FAQ: Will a free bankruptcy consultation help me feel less stressed about my debt?

Yes. Many people describe walking into a consultation feeling overwhelmed and ashamed, but leaving with relief. That first meeting gives you clarity about what bankruptcy would mean in your life. Myths fall away, and you can finally make decisions with facts instead of fear. Even if you decide not to file, just knowing your options helps lower stress.

The American Psychological Association has found that money and debt are among the top causes of stress, which is why the clarity offered through a free bankruptcy consultation can feel like “lifting a weight.”

And here’s something just as important: a good bankruptcy attorney will take the shame out of the process. Unfortunately, bankruptcy has a bad reputation. There are plenty of loud voices out there telling people to feel guilty for even considering it. For instance, Dave Ramsey has built a multi-million dollar brand teaching people to fight harder and avoid bankruptcy at all costs. A good attorney will address this head-on and show you that bankruptcy is not a moral failing. It’s a legal, ethical tool that gives people a second chance.

Watch: Attorney Adrienne Hines dispels the shame and myths spread by Dave Ramsey

Key takeaway: A free bankruptcy consultation reduces stress by replacing shame and fear with facts and clarity.

FAQ: What questions should I ask a lawyer during a free bankruptcy consultation?

You should ask five crucial questions that will help you get the most value from your consultation, and several that a good bankruptcy attorney will cover without you needing to ask.

The basics include:

- “Based on my income and debts, which chapter looks most likely, and why?”

- “What property is protected under my state’s exemption laws?”

- “What will my payment look like if I file Chapter 13?”

- “How much will this cost, including court fees and attorney fees?”

- “What could delay or complicate my case?”

Beyond the basics, the following five questions can reveal details that affect how smoothly your case goes:

- “How familiar are you with the local bankruptcy trustees and judges?”

- “What’s your process for communication? How quickly can I expect a response if I have a question?”

- “Have you handled cases like mine before (for example, with foreclosure, medical debt, or small business debt)?”

- “What happens if a creditor objects or files a motion during my case?”

- “After my bankruptcy is complete, do you offer resources for rebuilding my life, such as free enrollment into a credit-education course?”

Clients who ask both the basics and the deeper questions leave with a fuller understanding of what lies ahead, and more confidence in their choice of lawyer.

Key takeaway: The basics will be covered, but asking thoughtful follow-up questions helps you avoid surprises and gives you a clearer picture of how your attorney will handle your case.

FAQ: How many bankruptcy consultations should I schedule before hiring a lawyer?

Most people meet with one or two attorneys before deciding. Some hire the first lawyer they meet because the fit feels right. Others interview two or three, especially if they want to compare communication styles, fees, and strategies.

Think of it like choosing a doctor or financial advisor. You don’t need to meet ten, but talking to more than one can give you peace of mind. One thing to keep in mind is that the right attorney will help you see the full picture, not just the bankruptcy itself, but also life after bankruptcy.

Click here, and we can introduce you to a lawyer who will continue to support you after your bankruptcy by enrolling you for free into 7 Steps to a 720 Credit Score.

Key takeaway: Talking to more than one lawyer can give you confidence, but the right lawyer will go beyond the case and prepare you for rebuilding after bankruptcy.

FAQ: Can I decide not to file after a free bankruptcy consultation?

Of course! You are never obligated to file just because you had a consultation. Some people learn that bankruptcy is not necessary right now. Others choose alternatives like debt negotiation, repayment plans, or simply waiting to see if their situation improves.

Lawyers expect this. The goal of the consultation is clarity, not pressure. Many clients walk away with information and return later only if bankruptcy becomes the best solution.

Key takeaway: A free consultation gives you options. You can walk away, file now, or file later. The choice is always yours.

FAQ: How do I know if I found the right lawyer after a free consultation?

You know you’ve found the right lawyer if you leave the consultation with clear answers, no judgment, and a sense of trust. A good attorney explains things in plain language, treats you with respect, and makes the process feel manageable instead of overwhelming.

What makes a good lawyer? Here is a checklist.

✓ They listen without judgment and explain your options clearly.

✓ They answer your questions directly, not vaguely.

✓ They respect your time and give you a plan you can understand.

✓ They look beyond just “filing your case” and care about what happens after.

✓ After the consultation, you know the answer to the following questions:

- “Based on my income and debts, which chapter looks most likely, and why?”

- “What property is protected under my state’s exemption laws?”

- “What will my payment look like if I file Chapter 13?”

- “How much will this cost, including court fees and attorney fees?”

- “What could delay or complicate my case?”

✓ They’ve handled cases with the trustees in your district before and know how each tends to approach issues. Local experience matters because trustees vary in style and expectations.

✓ They have a clear process for communication and tell you how quickly you can expect a response if you have questions.

✓ They can point to experience with cases like yours, i.e., foreclosure, medical debt, or small business debt.

✓ They explain how they would handle it if a creditor objects or files a motion in your case.

✓ They provide resources for rebuilding life after bankruptcy, such as free enrollment in a credit-education course.

Key takeaway: The right lawyer answers the basics and goes further, showing local knowledge, setting clear expectations for communication, drawing on experience with cases like yours, explaining how they’ll handle challenges, and giving you resources for rebuilding after bankruptcy.

If you would like to be paired with a bankruptcy attorney in your state who offers a free consultation, click here to schedule a meeting with a debt professional.

About the Author

For more than 30 years, Philip Tirone has dedicated his career to helping people recover from financial setbacks and rebuild stronger futures. He works directly with debtors, pairing them with compassionate bankruptcy attorneys who can provide the legal protection they need.

Philip has also designed free resources, including 7 Steps to a 720 Credit Score, so that individuals not only get out of debt but also learn how to thrive after bankruptcy. His approach combines practical legal connections with long-term credit rebuilding support, giving people both immediate relief and a clear path forward.