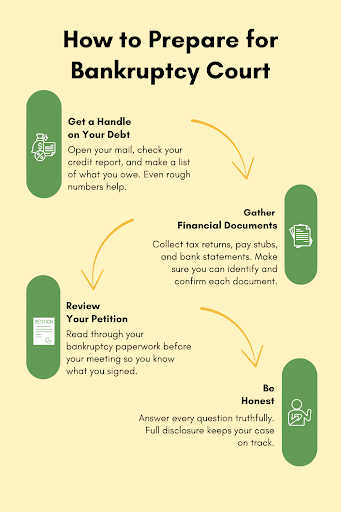

How to prepare for bankruptcy court? Here are the three big takeaways:

- The best preparation is practical: know your debts, gather financial documents, and review your petition.

- Honesty is the foundation of the bankruptcy process. Full disclosure protects you and helps your case move forward smoothly.

- The 341 meeting is most often done over Zoom, and it lasts only a few minutes.

Why Preparation Matters

When you picture “bankruptcy court,” your mind probably goes straight to what you’ve seen on TV: A packed courtroom. A judge with a gavel. And lawyers trading heated objections.

That’s not how bankruptcy court works.

In the world of bankruptcy, going to “court” usually means attending the 341 meeting of creditors. This isn’t a dramatic showdown. It’s usually a quick and simple meeting, often held on Zoom, where a trustee runs through a standard checklist: You’ll be asked to confirm that the paperwork you filed is accurate, that you signed it, and that you’ve turned in copies of your tax returns and other financial documents.

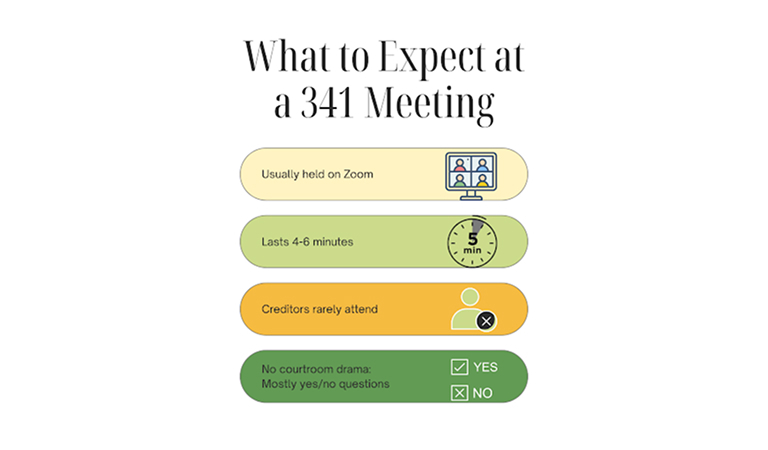

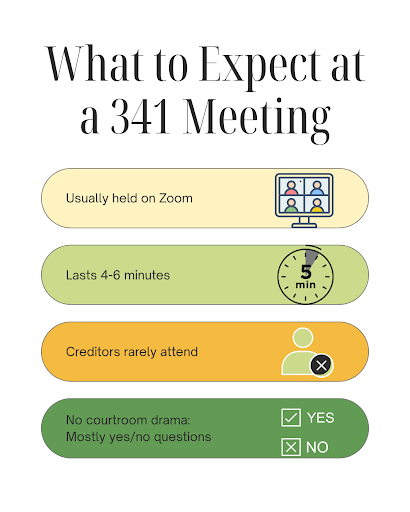

What to Expect at Your 341 Meeting

The 341 is often the most dreaded part of the bankruptcy process, but you might be surprised to know that it is a simple, quick meeting. Here are some details:

- Usually held on Zoom

- Lasts about 4 to 6 minutes

- No courtroom drama: Just yes/no questions about your documents

- Creditors rarely attend

How Do I Prepare for Bankruptcy Court?

The real challenges in bankruptcy come before you attend the 341 meeting. If you are prepared and have done your legwork, the 341 meeting will go well.

Knowing your debts, reviewing your paperwork, and having your documents ready will make you feel much more confident and in control when the meeting begins, so let’s take a look at this process, step by step.

How to Get a Handle on Your Debt (Step One)

A lot of people who file bankruptcy have stopped opening their mail. They feel overwhelmed by the amount of money they owe, so they stop keeping a tally.

And some creditors, like payday lenders or medical providers, don’t always report to the credit bureaus. That means you cannot rely on your credit report for a full picture of the debt that you would like to have included in your bankruptcy.

What Documents You’ll Need to Gather (Step Two)

In addition to outstanding debt, you’ll need to provide accurate copies of documents like:

- Tax returns

- Pay stubs or W-2s

- Bank statements

At your 341 meeting, you’ll be asked whether you submitted true and correct copies of your financial documents. You don’t have to understand every line of your tax return, but you should know what the document is and confirm that it’s yours.

Watch and Learn: What Can Ruin Your 341 Bankruptcy Hearing

Why You Need to Read Your Petition (Step Three)

Most people don’t realize how simple the 341 meeting really is. Trustees ask standard questions such as:

- “Did you read your bankruptcy petition?”

- “Did you sign it?”

- “Is it true and correct?”

- “Did you submit a copy of your tax return?”

These are not “gotcha” questions. If you’ve read your petition and know what you signed, you’ll feel comfortable answering these questions, and the 341 meeting will feel a lot more comfortable.

Why You Should Always Tell the Truth

The foundation of the bankruptcy system is honesty and full disclosure. Be truthful about your debts, income, and assets. If you discover a creditor you forgot to list, amend your petition right away. There’s usually a small filing fee, but it prevents bigger problems later.

By now you can see that preparing for bankruptcy court is less about courtroom drama and more about organization, paperwork, and honesty. Still, it’s normal to have questions about what happens if you forget a debt, how long the meeting takes, or whether you’ll have to appear in person.

That’s why we’ve pulled together answers to the most common questions people ask about preparing for bankruptcy court.

FAQs

Preparing for Bankruptcy Court

- Do I need a lawyer with me at the 341 meeting?

- What’s the most important thing I can do to prepare for bankruptcy court?

- What should I wear to bankruptcy court?

- Do I need to bring any documents to the 341 meeting?

- Will I have to appear in person for bankruptcy court?

- How do I prepare if I don’t understand my financial paperwork?

- What happens if I forget to list a debt in my bankruptcy?

During the 341 Meeting

- What happens in a 341 meeting?

- Can creditors show up in bankruptcy court and ask me questions during the 341 meeting?

- Who is the bankruptcy trustee at my 341 meeting?

- When does the 341 meeting happen?

- Is the 341 meeting private in bankruptcy court?

- Will a judge be at my 341 meeting?

- What kinds of questions will the trustee ask me in bankruptcy court?

- How long does the bankruptcy court 341 meeting take?

- What happens after the 341 meeting is over?

- What’s the hardest part of the 341 meeting?

Mistakes to Avoid in Bankruptcy Court

FAQ: Do I need a lawyer with me at the 341 meeting?

Yes, most people go through the 341 meeting with their bankruptcy lawyer by their side. An attorney’s job is to prepare you ahead of time, file your paperwork correctly, and make sure you don’t get tripped up by avoidable mistakes. The exception to this is if you filed your bankruptcy case without an attorney (what’s called “pro se”). In this case, you’ll attend the meeting and answer the trustee’s questions yourself. Having a lawyer there is reassuring because they can step in if anything unusual comes up, but the meeting itself is usually so straightforward that many people are surprised by how quickly it goes. See related blog: “How to File Bankruptcy Without a Lawyer and Whether You Should” Back to TopFAQ: What’s the most important thing I can do to prepare for bankruptcy court?

FAQ: What should I wear to bankruptcy court?

Wear clean, neat clothes that show respect for the process, but you don’t need to dress like you’re going to a wedding. Business casual works well, meaning slacks or khakis with a collared shirt, or a simple blouse and sweater. Avoid gym clothes, pajamas, or anything that might make you look like you aren’t taking the meeting seriously.

That said, do not buy anything new for the meeting. Borrow something from a friend or family member if you don’t have business casual clothes. If you don’t have access to business casual, do your best: comb your hair, make sure your clothes are clean, and be polite and friendly during the meeting.

Back to Top

FAQ: Do I need to bring any documents to the 341 meeting?

You’ll need to have a government-issued photo ID and proof of your Social Security number, such as your Social Security card or a W-2 that lists it, and you may want to bring copies of your tax return, financial documents, and bankruptcy petition.

The trustee will have your tax returns and other financial documents, but having copies for your help may help if you are asked to confirm information from them. Many people also bring a copy of their bankruptcy petition to glance at before the meeting begins. Having these items ready avoids delays and shows the trustee you’re organized.

Back to Top

FAQ: Will I have to appear in person for bankruptcy court?

No, you most likely will not have to appear in person for bankruptcy court. Most 341 meetings are held virtually, often on Zoom. You’ll log in, answer questions under oath, and be done in about five minutes.

Back to Top

FAQ: How do I prepare if I don’t understand my financial paperwork?

If you’re confused by your tax return, bank statements, or pay stubs, that’s okay. You don’t need to be an expert, and the trustee won’t test your math and accounting skills. Instead, the trustee wants to make sure you are being truthful and thorough.

That said, you do need to recognize the documents and know that they are accurate. Review them with your attorney before the meeting so you feel comfortable explaining what they are.

For example, you might not understand every line of your tax return, but you should be able to say, “Yes, that’s my return for last year and it’s complete.”

Back to Top

FAQ: What happens if I forgot to list a debt in my bankruptcy?

FAQ: What happens in a 341 meeting?

The 341 meeting is quick, organized, and generally held over Zoom. First, the trustee will start the 341 meeting, usually by opening the Zoom room. There may be several other debtors filing bankruptcy in the same Zoom room since trustees often schedule multiple cases at the same time. Sometimes everyone stays in one Zoom room, and sometimes the trustee uses breakout rooms for privacy.

The process goes like this:

- The trustee makes a few announcements and then calls attendance.

- Then the trustee starts taking individual cases.

- When your case is called, you will be sworn in and placed under oath.

- The trustee will then ask a standard list of questions, such as whether you read and signed your bankruptcy petition, whether it’s accurate, and whether you listed all your assets and debts.

Creditors have the right to attend, but in a Chapter 7 or Chapter 13 case, they rarely show up. Most 341 meetings last only a few minutes. Dismissals can happen after a 341 meeting, but they do not happen during the meeting. Generally, 341 meetings are short, straightforward, and usually uneventful unless someone lies or leaves out important information.

That said, the trustee’s role doesn’t end at the meeting. If you have non-exempt assets (like a second car, valuable collectibles, or money in certain accounts), the trustee may sell those items and distribute the proceeds to creditors. In most consumer cases, though, there are no non-exempt assets, so the trustee files a “no distribution” report, and no money is paid out.

Bottom Line: A 341 meeting is a brief, routine step in bankruptcy where the trustee confirms your paperwork under oath. It usually happens on Zoom with several other debtors present, lasts only a few minutes, and runs smoothly as long as you’re honest and prepared.

Back to Top

FAQ: Can creditors show up in bankruptcy court and ask me questions during the 341 meeting?

Yes, creditors are legally allowed to attend the 341 meeting, but in reality, most creditors don’t have the time or interest to send someone to a short meeting where they are unlikely to recover any money. If a creditor does show up, they can only ask limited questions about your finances or your bankruptcy petition. For most people, the meeting feels less like “facing your creditors” and more like a routine interview with the trustee. Let’s break it down … In a Chapter 11 bankruptcy, which is primarily used by businesses, creditors do show up. This is because there are many millions of dollars at stake, so it makes sense to send an attorney. But in a Chapter 7 bankruptcy? Check out the video to learn more.If you are declaring Chapter 13 bankruptcy, it’s a little more common for a secured creditor to attend, especially if your repayment plan affects how their loan will be treated. For example, a mortgage lender might want to confirm how arrears will be handled, or a car lender may ask about insurance. Even then, their involvement is usually brief and limited to making sure their collateral is protected.

In summary: While creditors technically have the right to attend your 341 meeting, most won’t show up in Chapter 7 or Chapter 13 cases because it isn’t worth their time. When they do, it’s usually a secured creditor (such as a car lender or mortgage company) asking a quick question to make sure their collateral is protected. For the vast majority of people, the 341 meeting feels more like a routine check-in with the trustee than a confrontation with creditors.

FAQ: Who is the bankruptcy trustee at my 341 meeting?

The bankruptcy trustee is the court-appointed person who runs your 341 meeting. They are not a judge. Their job is to review your paperwork, ask you questions under oath, and make sure your information is accurate and complete.

Bankruptcy trustees are private individuals appointed by the U.S. Trustee Program, which is part of the Department of Justice. Most are experienced bankruptcy attorneys or accountants with specialized knowledge of financial records, debt, and bankruptcy law. They must go through background checks, meet strict ethical standards, and are regularly monitored to ensure they handle cases fairly. Trustees also complete continuing education to stay current on bankruptcy rules and procedures.

Trustees are paid by the court system, not by you directly. In a simple Chapter 7 case with no assets, they get a small flat fee (about $60). If you own non-exempt property that can be sold for the benefit of creditors, the trustee oversees that process and earns a commission. In some cases, they also do legal work, which has to be approved by the court.

The trustee isn’t there to embarrass you. They want to confirm things like whether you read and signed your petition, whether your tax return and pay stubs are correct, and whether you’ve disclosed all assets and debts. If you’re honest and prepared, the trustee’s role will feel more like a checklist than an interrogation.

Bottom Line: The trustee is a trained professional, usually a lawyer or accountant, appointed by the Department of Justice to administer your bankruptcy. They don’t decide whether you “deserve” bankruptcy. Rather, they make sure your case is accurate and complete.

Back to Top

FAQ: When does the 341 meeting happen in a bankruptcy?

The 341 meeting generally happens 28 to 45 days after you have filed your bankruptcy, depending on the court calendar. The court clerks will set the date, and you will not have control over when it will happen.

Back to Top

FAQ: Is the 341 meeting private in bankruptcy court?

FAQ: Will a judge be at my 341 meeting?

No, a judge is never present at the 341 meeting. These meetings are handled by bankruptcy trustees, not by judges.

FAQ: What kinds of questions will the trustee ask me in bankruptcy court?

Trustees ask a standard list of questions at every 341 meeting, and they’re the same no matter where you file. The purpose is to confirm that your bankruptcy paperwork is complete, accurate, and truthful. In most cases, these are yes/no questions. The trustee simply wants to make sure your paperwork matches your financial reality. They may ask for clarification if something looks unusual, but there are no trick questions. If you’ve reviewed your petition, gathered your documents, and are honest in your answers, you’ll be prepared for your 341 meeting.

Check out this clip for a sampling of the questions you will be asked during your 341 meeting.

FAQ: How long does the bankruptcy court 341 meeting take?

The 341 meeting usually lasts only four to six minutes.

Back to Top

FAQ: What happens after the 341 meeting is over?

Once your 341 meeting is finished, your case usually moves forward toward discharge, which is the official elimination of your eligible debts. You’ll still need to complete a required debtor-education course and submit any final documents the trustee asks for. If you stay on top of these steps and there are no objections from creditors, you won’t have to attend another hearing.

A discharge notice typically arrives in the mail within a few months. That document confirms your bankruptcy went through and that your debts are cleared.

Dismissals can happen after a 341 meeting, but not during the meeting itself. The trustee does not dismiss cases on the spot. Instead, dismissal happens later if you fail to meet requirements, like skipping the debtor-education course, not turning in requested paperwork, or missing multiple 341 meetings.

Bottom Line: The 341 meeting is usually the only live step you attend. If you finish your education course, respond to trustee requests, and remain truthful, your case will move smoothly to discharge. Dismissals are rare and occur only if follow-up requirements aren’t met.

Back to Top

FAQ: What’s the hardest part of the 341 meeting?

Most people say that the hardest part of the 341 meeting is managing their anxiety. Assuming you have told the truth, the 341 meeting will otherwise be easy and fast. You’ll answer a handful of (mostly) yes or no questions, and, assuming you have been truthful, the meeting will conclude after the trustee has confirmed the details submitted in the bankruptcy paperwork.

FAQ: What happens if I miss my 341 meeting?

If you miss your meeting, you will need to reschedule. The 341 meeting is a required part of the bankruptcy process, and your case cannot move forward until it’s complete. Trustees will usually allow one reschedule if you have a valid reason, but if you fail to attend more than once, your case can be dismissed. That means you’d lose bankruptcy protection and might have to start the process over. If you know you can’t make the date, let your attorney or trustee’s office know as soon as possible so they can help arrange a new time.

FAQ: Can I reschedule my bankruptcy court date?

Yes, you can request to reschedule your 341 meeting if you have a serious conflict, such as a medical appointment or unavoidable travel. The request should go through your attorney, if you have one. Otherwise, you should contact the trustee’s office directly.

Let your attorney or the trustee’s office know as soon as possible. If you simply don’t show up without notice, your case may be delayed or dismissed.

That said, as long as you communicate quickly and have a valid reason, rescheduling is usually not a problem.

FAQ: What is the best way to get through my bankruptcy meeting without problems?

The real secret is simple: be completely honest and disclose everything. Trustees get paid very little in most Chapter 7 cases (about $60 if there are no assets to distribute), so they don’t have time to play detective. If your paperwork is accurate and truthful, the 341 meeting will likely be much smoother. When your petition is complete, your financial documents are organized, and you’ve told the truth about your situation, the meeting usually lasts only a few minutes.

From a debtor’s perspective, this means resisting the temptation to hide anything, even if you think no one will ever find out. For example, if you own cryptocurrency, got a cash gift, or have a side account, disclose it. If you try to conceal it and the trustee finds out, you risk losing your discharge, and your debts could become permanently non-dischargeable. But if you’re upfront, even about awkward or unusual assets, the trustee may decide it’s not worth pursuing, and you’ll still get your discharge.

FAQ: What is the likelihood that my bankruptcy case will be thrown out?

If you are truthful and complete in your paperwork, your bankruptcy case is unlikely to be dismissed and will most likely end in discharge. The biggest problems come when people lie, hide assets, or fail to disclose income or accounts. Trustees warn debtors at the start of every 341 meeting that it’s a crime to conceal assets or make false statements. If you try to cover something up, you risk having your discharge denied and your debts declared permanently non-dischargeable.

Statistics also show that having an attorney matters. In Chapter 13 cases, more than 99% of people who file pro se (without an attorney) fail, and their cases are dismissed. By contrast, most people who file with an attorney and provide honest, complete information do receive a discharge.